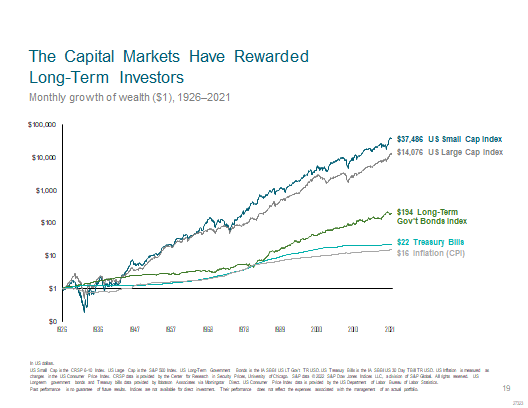

Our investment approach is based on a belief in capital markets. We invest with the core beliefs that securities are fairly priced in liquid and competitive markets, diversification is essential, and investing involves trading off risks and costs with expected returns.

We build portfolios based on the science of capital markets. Our approach focuses on academic research that isolates factors that tend to outperform the broad market over long periods of time. This approach also enables us to identify risk characteristics that can be eliminated from a portfolio. Decades of financial research have identified specific characteristics of higher expected returns in global capital markets. These characteristics are the factors that explain differences in returns that are persistent through time and pervasive across markets. These characteristics can be simply summarized. Stocks have higher expected returns than bonds and the relative performance among stocks largely depends on company size, relative price and profitability. Term and Credit are the two characteristics that largely drive relative performance in fixed income. We construct portfolios around these dimensions that are broadly diversified backed by research.

More specifically, we help you manage your portfolio’s risk and return profile by allocating your money across the equity and fixed income asset classes with risk factors that have higher expected returns. We combine equity with short term fixed income to create portfolios that meet your risk tolerance and financial goals. Aspen Financial Solutions is a member of a select group of fee-only financial advisory firms with access to the innovative investment solutions offered by Dimensional Fund Advisors. As a result of this relationship, you have exclusive access to Dimensional mutual funds that we utilize to create your investment portfolio.

Aspen Financial Solutions’ services include:

- Investment management

- Asset allocation

- Retirement strategy

- Full service 401(k) – creation, asset selection, employee enrollment/education and ongoing administration

Trusted Partners:

Registrations:

Aspen Financial Solutions is registered with DORA and FINRA.

DORA stands for the Division of Professions and Occupations Regulatory Agencies, which is responsible for regulating several professions and occupations in the state of Colorado, USA. Being registered with DORA means that Aspen Financial Solutions has met the necessary qualifications and requirements to practice as an investment advisor within the state of Colorado.

FINRA, or the Financial Industry Regulatory Authority, is a non-profit organization authorized by the United States Congress to regulate broker-dealers and other financial institutions operating in the United States. Aspen Financial Solutions is subject to FINRA’s rules and regulations, which are designed to protect investors and maintain the integrity of the financial industry. Registration with FINRA involves a thorough background check and passing a series of exams.